Investing is a skill that can be learned fairly simply, starting with a small amount of money. What is more difficult is how to think like an investor consistently. This is the skill you will need to create the financial future you want.

In this post, I’ll take you through 5 practical steps to start and stay thinking as an investor does.

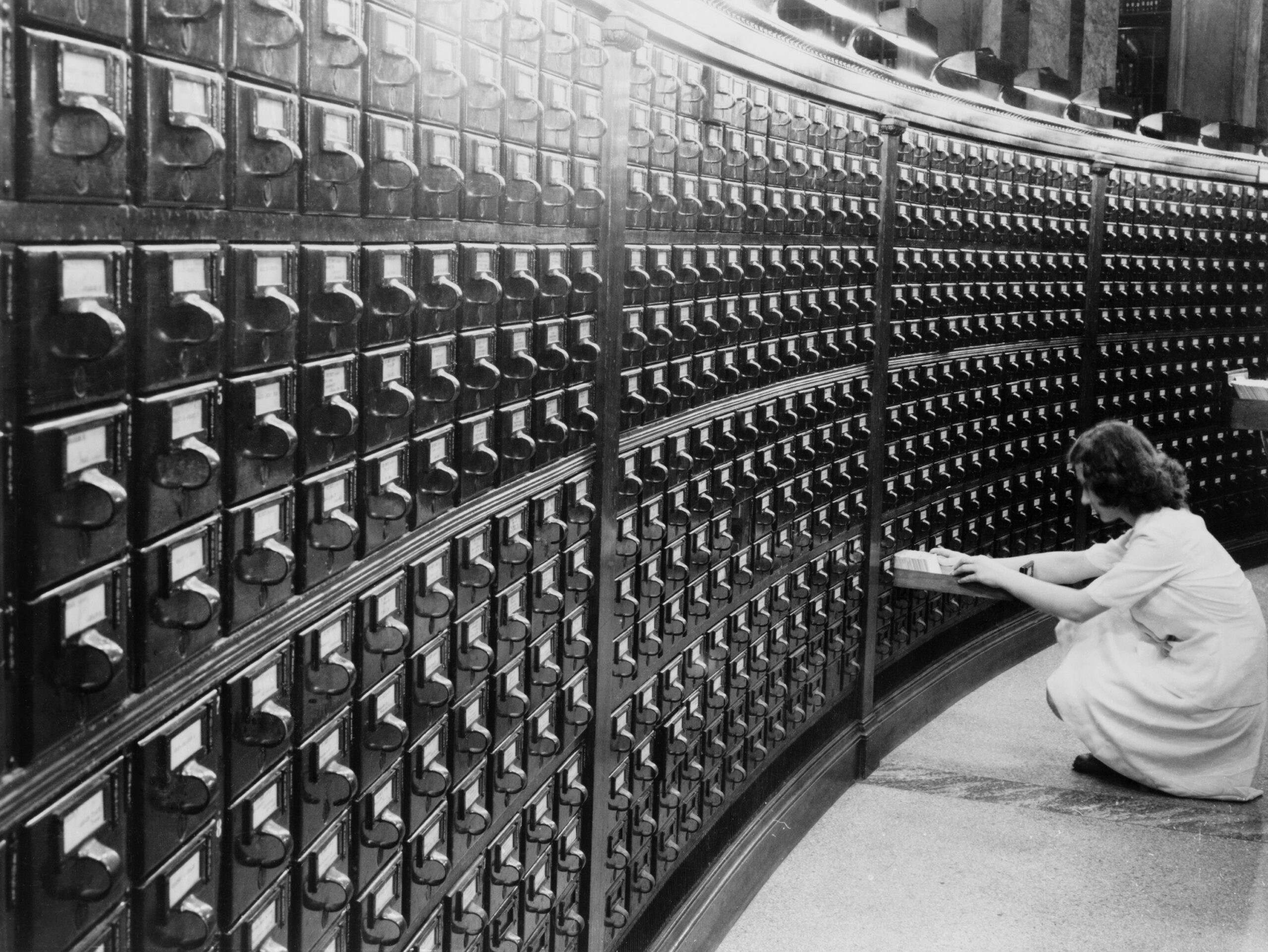

INVEST IN YOUR FINANCIAL EDUCATION

The main reason that most people don’t invest in the stock market is that they don’t understand money and financial markets. We are not taught anything useful about money at school – how to make money, manage money or grow it!

So please don’t feel bad about this or that you ‘should’ have started sooner or done more. This not our fault but a massive oversight in our education system.

The solution is very simple. Invest some time into your financial education! Choosing to spend time learning to invest is the best thing you can do to improve your financial future and become wealthy.

You are, after all, your most important asset. Investing is as difficult (or easy) to learn as driving a car.

BREAK IT DOWN INTO SMALL STEPS

Investing is about starting small and taking one step at a time. Progress is more important than perfection.

It is easy to think that we need big chunks of time to learn anything new. But I’ll let you into a secret.

If you can dedicate small and focussed periods of time to learn on a consistent basis, you will reap the rewards. Ten or twenty minutes a day is more than enough!

I set an alarm and do this on a regular basis to tackle things I really don’t want to do and am resisting. This includes all my investing admin.

As Desmond Tutu put it so wisely: ‘’There is only one way to eat an elephant, a bite at a time.’’

MANAGE YOUR EMOTIONS

The stock market goes down and up in value all the time, sometimes more dramatically than others. Your investments will too. This is normal and to be expected.

That doesn’t mean you will like it. You will have lots of feelings about it. Ranging from fear, worry, excitement and enthusiasm.

There is nothing wrong with feelings. But successful investors don’t make decisions based on them.

The thing is to be aware of them rather than react to them. Keep calm and carry on!

Here are some handy tips to manage your emotions when dealing with financial matters:

- Keep busy.

- Turn off notifications on investing apps. Or remove them from your phone altogether.

- Steer clear of doom-laden news that might cloud your rational judgement.

- Don’t make any rushed decisions.

- Remember the Magic of Compounding and the long-term perspective:

“The most important quality for an investor is temperament, and not intellect.”

Warren Buffet, CEO of Berkshire Hathaway.

BE CONSISTENT AND BORING

Simple, successful investing isn’t exiting. It is boring. If it’s exciting then it is likely you are following a story of what you think (or someone else thinks) will be the The Next Big Thing.

But how do you actually know this for sure? Because no one really knows what is going to happen on the stock market.

History shows that investing money steadily and consistently in long-standing, and seemingly ‘boring’ companies can give outstanding returns. Chasing the latest trends or innovations in the investment world can be riskier than putting money into a diversified range of established companies with proven track records.

As Paul Samuelson famously says, ‘‘Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas!’’

REMEMBER THE POINT OF IT ALL

The purpose of investing is to live from your assets or the money your assets are making. You are aiming to live on your capital rather than live from your labour. It’s a long-term project.

The ups and downs of your investments over the past 12-18 months don’t really matter in the grand scheme of things. Save and invest for another 10, 20 or 30 years and you’ll struggle to see the wobble in your records.

Navigating the world of finance need not be overwhelming. When you invest time in your financial education, take the next step, are aware of your feelings, embrace consistency and think for long term you have the foundations to live from your money, rather than your work.

Are you ready to get started? Download your Seven Simple Steps to Start Investing Today!

If you enjoyed this post, you may also enjoy:

Why is Investing so Scary? And Why You Should Do it Anyway

Forgotten Female Investors: Female Investors Who Defied the Odds

Disclaimer: Simple Successful Stocks are not financial advisors and the content of this article is for financial education only. Please read our disclaimer here.